It’s almost the end of the financial year!

Okay…we can probably turn down the enthusiasm. For many people, doing their taxes is a chore that reminds them just how much they are giving to tax, or how much HECS they still have to pay off.

The good news is, nurses can actually save tax through tax deductions. Learn more about what you can claim, and how to claim it. A few of them may surprise you.

What is a tax deduction?

Before we begin explaining tax to you, it’s important to mention that we aren’t a qualified financial advice provider. For professional help with your taxes or finances, speak to an expert.

With that said, we can give you a comprehensive overview of the key information, and how you can get some money back at tax time.

A tax deduction is an expense that you have paid, that the Australian Tax Office (ATO) deems a workplace expense. You can then be reimbursed either the total or a portion of the expense. This reimbursement occurs when you complete your tax return each year.

For something to qualify as a workplace expense:

- The expense must have been made with your own money, and your employer must not have reimbursed you

- The expenses must be relevant to your occupation

- You need to be able to prove the value of the expense, and how you calculated it

Even if these criteria are met, some expenses still might not be covered. The trick to maximising your deductions is to claim everything that is applicable to you, provided you have proof of the expense, and then the worst that can happen is that the deduction is declined.

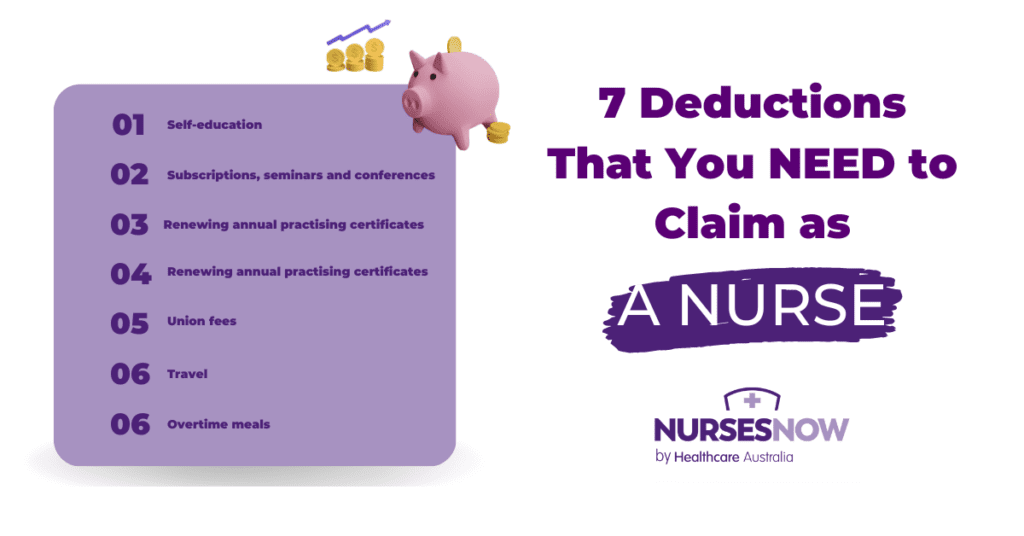

The following 7 tax saving deductions are listed by the ATO as acceptable deductions for nurses.

7 Deductions That You NEED to Claim

1. Self-education

As a nurse, your pay scales with your qualifications. This means that furthering your education is actually a requirement for career advancement and increasing your income. Furthermore, if you are an agency nurse who wishes to work in a different field, you may find yourself needing to acquire extra qualifications.

Medical science is always advancing, and nurses must retrain constantly over the course of their careers. This is true even if they intend to stay in the same role.

Applicable deductions for educational expenses can include:

- Course fees

- Student and amenities fees

- Scholarly journal subscriptions

- Textbooks

- Stationary and home office set up

Whether you are undertaking further studies to improve your salary or to maintain your qualifications, deducting your study expenses is worth considering.

2. Subscriptions, seminars and conferences

If you aren’t formally studying, but you engage in educational activities that directly relate to nursing, you may be able to save some tax. For agency nurses in particular, who may work in various healthcare fields and use these activities to stay current, this is a great deduction to consider.

Just remember, the ATO will determine whether the deduction is valid based on how relevant it is to your role, so don’t be too liberal with your claims. If it doesn’t directly relate to nursing, or improve your abilities as a nurse, don’t mention it.

3. Renewing annual practising certificates

You can deduct the cost of renewing your annual practising certificates. The government recognises that they are mandatory for you to be able to work in your industry, and are therefore a work expense. It is important to note that the deduction is only valid for the renewal, not for actually attaining the certificates in the first place.

4. Uniforms and laundry

The government doesn’t consider everyday clothing, like jeans or plain shirts, as work clothing. Even if you wear them for work, they could still technically be worn in your personal life. The cost of uniforms that are job specific, however, can be claimed. Examples of work-specific clothing are:

- Hi-Vis clothing

- Protective clothing like gloves, face masks and eye shields

- A uniform that is mandatory for the role, such as a uniform with business branding

- Work-specific clothing articles, like non-slip nursing shoes

You can also claim laundry expenses on these items, calculated at $1 for every load of work clothing that is washed separately, or 50c for every load mixed with your regular laundry.

5. Union fees

Union fees are one of the most common deductions for any profession. Luckily, claiming them is easy. Unlike many of the other deductions on this list, you don’t have to calculate or keep track of union fees. Your yearly income statement will state the sum of your union fees for that financial year. Simply quote that number in your tax return and you should get a full reimbursement.

6. Travel

This is the most relevant deduction for agency nurses. Driving too and from work isn’t deductible, but in some instances, it can be you don’t have a fixed address. For agency nurses who are frequently travelling between shifting workplaces, you may be able to claim travel expenses.

If you travel long distances for work and have to stay overnight, such as temporarily working in a regional area, you can claim the associated travel costs. Provided your employer hasn’t given you an overnight travel allowance, you can also claim the cost of meals and accommodation.

To record the expense, you can either keep a valid logbook or calculate how many cents per kilometre were spent on travelling for work. Either way, your supporting material is likely to be checked so be honest and reasonable with your claims.

If you are claiming based on any of these reasons, but you have used public transport instead of a personal vehicle, you can still deduct these costs. Make sure that you keep receipts, tickets or bank statements to prove that the transport occurred.

7. Overtime meals

When you work overtime, you may be entitled to additional meal breaks. If your income statement has a separate allowance entry for overtime meals, and you include this allowance as income in your tax return, you can make the deduction.

While getting a free meal is already a great reason to consider this deduction, it is also an easy one to lodge. Any time you get an overtime meal, simply hold on to the receipt. If you aren’t eating them very often, the government may not even need proof of the purchases. Receipts only need to be provided after the amount being claimed becomes unreasonable.

What Kind of Nurse Saves the Most Tax?

You may have noticed that agency nurses have some unique tax benefits. Agency work provides freedom and flexibility – and it can also save you more tax!

Nurses Now is a leading nursing agency that specialises in giving you the opportunity to experience different opportunities in a way that suits your professional goals. They also pay above award rate, which means with the extra deductions, agency nursing is the most financially viable option for you to take.

Checkout the website for more information, or join today.

Resources

- Quick guide to nurse and midwife deductions: https://www.ato.gov.au/uploadedFiles/Content/IAI/Downloads/Toolkits/TaxTimeToolkit_Nurseormidwife.pdf

- ATO list of nurse and midwife deductions: https://www.ato.gov.au/Individuals/Income-and-deductions/In-detail/Occupation-and-industry-specific-guides/Nurses-and-midwives—income-and-work-related-deductions/?anchor=Deductions#Deductions